Skyway Capital Markets is pleased to announce Greg Mausz, its chief operating officer and senior managing director, has received recognitions by the Alternative & Direct Investment Securities Association (ADISA).

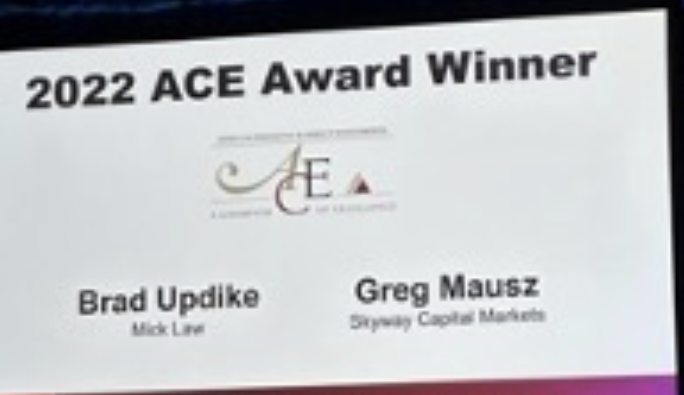

During ADISA’s 2022 Annual Conference & Trade Show in Las Vegas last month, Mr. Mausz was named A Champion of Excellence (ACE), the association’s highest honor.

“I am honored by this recognition and want to congratulate all of this year’s recipients. It takes everyone’s efforts to move the industry forward and we appreciate the leadership and advocacy of ADISA to bolster our successes,” remarked Mr. Mausz.

In addition to the ACE award, Mr. Mausz was also re-elected to the ADISA 2023 board of directors and will serve as a director at large. The new directors were elected to a two-year term through 2024.

“It’s a privilege to serve the members of ADISA. The Board continues to work hard to grow and support the industry in providing quality alternative investment offerings for investors,” remarked Mr. Mausz.

ADISA is the nation’s largest trade association representing the non‐traded alternative investment space. ADISA’s members are typically involved in non-traded real estate investment trusts, business development companies, master limited partnerships and private and public funds (LPs/LLCs), 1031 exchange programs (DSTs/TICs), energy and oil and gas interests, equipment leasing programs, or other alternative and direct investment offerings. The association has approximately 5,000 members who are key decision makers, representing more than 220,000 professionals throughout the nation – including sponsor members who have raised in excess of $200 billion in equity and serve more than 1 million investors.

In his role at Skyway, Mausz is responsible for continuing to enhance Skyway’s infrastructure, oversee due diligence and work with quality asset managers to develop alternative investments for distribution to the independent broker dealer and registered investment advisor (RIA) community.

Mausz has more than 27 years of experience and has been focused on the alternative investment universe since 2000. He has worked for a variety of firms ranging from independent brokers, RIAs to third-party due diligence and multiple alternative sponsors. Collectively he has led more than $12 billion in capital raising for a diverse mixture of products including public and private REITs, BDCs, Preferred Stock, and fund offerings across a mix of asset classes which include real estate, private equity, credit and energy.